“Since 2020, housing needs have become even more pronounced due to increased inflation, rising rents, rapid house price appreciation, and higher mortgage interest rates.” — Joseph Von Nessen, Ph.D. in the Palmetto State Housing Study 2023

By Tammy Palmer, SC Housing Chief of Staff

In June 2022, the South Carolina Legislature passed a budget proviso requiring the South Carolina Housing Finance and Development Authority (SC Housing), in partnership with the University of South Carolina Darla Moore School of Business, to conduct a statewide housing needs assessment.

In June 2022, the South Carolina Legislature passed a budget proviso requiring the South Carolina Housing Finance and Development Authority (SC Housing), in partnership with the University of South Carolina Darla Moore School of Business, to conduct a statewide housing needs assessment.

The Palmetto State Housing Study was launched to fulfill this mandate. The purpose of the 2023 study is to examine the primary drivers of housing supply and demand and the impacts these drivers have on affordability across various geographies, family structures and income levels.

Due to the all-encompassing nature of the proviso, the Housing Study has been organized into three phases.

Phase 1

Our first phase includes the “Supply and Demand Analysis,” which is an evaluation of the trends and conditions associated with housing stock across the state and begins to identify the primary drivers of housing needs.

Phase 2

The second phase will incorporate public engagement and input from organizations and persons interested in housing assistance and development.

Phase 3

The third phase will culminate in a summary of policy recommendations based on findings from the two previous phases.

All work under the State Housing Study will be completed and submitted to the S.C. Legislature in June 2023.

The key findings of the recently finalized Supply and Demand Analysis phase are relevant to all public policy stakeholders in South Carolina, particularly those focused on issues related to children and vulnerable populations.

Here are some highlighted findings:

The number of homes sold in South Carolina for less than $100,000 has decreased by 14.8% each year since 2014.

The number of homes sold in South Carolina for less than $100,000 has decreased by 14.8% each year since 2014.

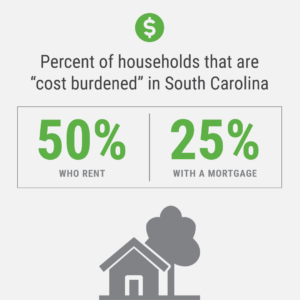

- Approximately 50% of households that rent and 25% of households with a mortgage are “cost-burdened.” As defined by the U.S. Department of Housing and Urban Development (HUD), a cost-burdened household is one that pays more than 30% of its income for housing.

- While the vast majority of cost-burdened households are those earning less than $35,000 a year, those earning between $45k and $75K and possessing a mortgage are also significantly cost-burdened. This status is especially pronounced for single parents with children. In this income category, 43% of households with one adult and three children are cost-burdened. For households with one adult and two children, 26% of them are cost-burdened.

- In 2022, the percentage of homes sold in South Carolina for under $100,000 fell below 5% for the first time.

- Every county in South Carolina contains areas where a majority of renters are cost-burdened. This holds true for even the most affluent counties and can be seen easily when we analyze census track data (as opposed to evaluating only county-level statistics).

Currently, SC Housing is in Phase 2 of the study. We encourage everyone to complete the Housing Engagement Survey hosted on our website. We look forward to hearing the insights of local housing authorities, community-based organizations, nonprofits, the private housing industry, and other organizations interested in housing needs.

For further information about the study, please email palmettohousingstudy@schousing.com. You can also subscribe to our email list and receive updates.

The mission of the South Carolina State Housing Finance and Development Authority (SC Housing) is to ensure that all South Carolinians have an opportunity to live in safe, decent, and affordable housing.

The Policy Forum takes an in-depth look at policy areas that impact children and families. It features guest columns from social workers, public health professionals, academic experts, legislators, and family-serving organizational leaders. To be a contributing writer, fill out this form.